🇧🇪 Belgium - English

The Re-Start Guidebook for Migrant Entrepreneurs

guidebook noun

— a book that gives useful information about a particular subject

— especially a book of information for travellers

entrepreneurship noun

— the activity of making money by starting or running businesses, especially when this involves taking financial risk

Introduction: Welcome to the EU!

Welcome to our guide for immigrants who are interested in starting their own business in the European Union!

We have created the Re-Start Guidebook for Migrant Entrepreneurs specifically to support you in your endeavour to turn your business dreams into reality.

We are writing this guide in 2023, so if you are reading it in the future, don’t forget to double check insurance, registration, tax and work permit information to make sure it is up to date.

The Re-Start Guidebook to Entrepreneurship is written for readers who have a B1 language level. In each chapter, we will introduce new vocabulary related to building a business.

Most of the new words are at a B2 level.

Important to know… 💡 Keep your eye out for the lightbulb which indicates information which is important to know…

Important to know… How long does it take for a new business to succeed?

💡Research shows that it takes a business three years before it will begin to make you money. This means that you must be prepared for the first three years to be difficult, and that you will have to work very hard in order for your business to survive. Don’t be discouraged if starting a business turns out to be tougher than you expected.

Throughout the guide, you will see the following boxes to help you:

New Words to Learn: These definitions explain the new vocabulary in the section. Guidebook (n): a book that gives useful information about a particular subject; especially a book of information for travellers Important to know… |

Infobox: Using the Re-Start Guidebook to Entrepreneurship

|

Questions to get you started: Use these exercises to build your business

|

Objectives of the Guidebook:

This guide will be a valuable resource to you as you learn how to be a successful entrepreneur.

Starting a business can be intimidating, especially when you are new in a country and are not familiar with its business environment. However, the European Union is home to a diverse and thriving business community, and there are many resources available to help you succeed.

Entrepreneurship can involve a lot of risks, be it financial, legal, or personal. This is true for many big life decisions. The Restart Guidebook for Migrant Entrepreneurs will equip you with the essential information you need to make informed decisions and take calculated risks as you build your business.

Some of the key areas we will cover include:

- Researching your market: Before you start your business, it is important to understand the needs and preferences of your potential customers. Researching your market will help you identify opportunities and tailor your products or services to meet the demands of your target audience.

- Creating a business plan: A business plan is a document that outlines the details of your business, including your goals, target market, financial projection with an estimate of profit and loss, and marketing strategy. Having a solid business plan will help you stay organised and focused as you launch and grow your business.

- Seeking out funding and support: Starting a business can be expensive, and you may need financial support to get your venture off the ground. We will provide you with information on different types of funding and support that are available to young entrepreneurs in the EU, including loans, grants, and crowdfunding platforms.

- Understanding local businesses: Every country has its own rules and regulations that apply to businesses. It is important to familiarise yourself with these laws and regulations to be sure that your business operations are legal and ethical.

Starting a business is challenging and rewarding. Our guide will help you to reduce the risk and improve your chances of success.

Then, when you are ready, you can launch your business with confidence!

| New Words To Learn Resource (noun): something that can be used to help achieve an aim, especially a book, equipment, etc. that provides information for teachers and students Intimidating (adjective): causing a loss of courage or self-confidence: producing feelings of fear or timidity Environment (noun): the circumstances, objects, or conditions by which one is surrounded Diverse (adjective): very different from each other and of various kinds Thriving (adjective): continuing to be successful, strong, and healthy Equip (verb): to prepare somebody for an activity or task, especially by teaching them what they need to know Essential (adjective): completely necessary; extremely important in a particular situation or for a particular activity Calculated Risk (noun): a risk that you decide is worth taking even though you know it might have bad results Area (noun): a particular subject or activity, or an aspect of it Market (noun): a particular area, country or section of the population that might buy goods; the number of people who want to buy something Potential (adjective): something possible that can become actual reality in the future Identify (verb): to recognise somebody/something and be able to say who or what they are Demand (verb): a very strong request for something; something that somebody needs Target (noun): a result that you try to achieve; a goal Projection (noun): an estimate of future possibilities based on a current trend Estimate (noun): a judgement that you make without having the exact details or figures about the size, amount, cost, etc. of something Profit (noun): the money that you make in business or by selling things, especially after paying the costs involved Strategy (noun): a careful plan or method Launch (verb): to make a product or service available to the public for the first time Funding (noun): money for a particular purpose Venture (noun): a business project or activity, especially one that involves taking risks Loan (noun): money that a bank lends and somebody borrows Grant (noun): a sum of money that is given by the government or by another organisation to be used for a particular purpose Crowdfunding (noun): the practice of funding a project or an activity by raising many small amounts of money from a large number of people, usually using the internet. Examples: Kickstarter, Indiegogo, Patreon Regulation (noun): an official rule made by a government or some other authority Familiarise (verb): to learn about something or teach somebody about something, so that you/they start to understand it Legal (adjective): allowed or required by law Ethical (adjective): conforming to a standard of what is right and good. |

Chapter 1. So You Want to Be An Entrepreneur in Belgium?

If you are a new citizen of Belgium or if you have migrant roots and the ambition to create your own business, then this guidebook is just the thing for you! Here is the very first place to start:

1. Legal conditions to become an entrepreneur in Belgium

Before you open any kind of business in Belgium, there are steps to follow and conditions to fill. You must fit these obligatory legal conditions to become self-employed in Belgium:

– Be 18 or older

– Not have been declared incompetent and not be on probation

– be able to exercise all of your civil and political rights

– be allowed to carry out all actions related to running a self-employed business;

No matter where you are from, you can start a business in Belgium. You must have the right to live in Belgium, the skills you need for your job, and French or Dutch language skills. The way to start a business is the same as it is for Belgium people, but there are extra steps to get permission to work.

The steps for the legal incorporation of a business are always the same, regardless of whether or not you are a foreigner. The only difference lies in the first step that any non-Belgian person will have to take: the need to become a legal resident in the country. Having legal status is mandatory. Once you achieve residency, the step-by-step is the same.

Infobox: Permission to Work Foreigners are permitted by law to start a business in Belgium, whether or not they are EU citizens. As a migrant or refugee from outside of the EU, there is important paperwork and registration to complete before you begin. The first step to living in Belgium is to get a legal status that gives you the right to live and work in Belgium. After you have your legal ID, the second step is to get yourself a professional card. The application fee is €140 and the same fee applies if you ever need to modify, renew, or replace it. The professional card allows you to work anywhere in Belgium as a self-employed person. Your application, however, is decided by the Flemish, Walloon, Brussels-Capital Region, or German-speaking Community, according to where you live. If you live in Belgium, applications should be made at a recognized business counter or “Guichets d’entreprise”. |

Important to know… Tax Requirement

💡 The system for paying taxes when you own a company is different from country to country. It is important to know the tax requirements and any other liability involved in running a business before you start. We have gathered the basic information for you in this guidebook, but you should always consult with an accountant and notary before you start. You can make sure to avoid costly mistakes by discussing your situation with professionals from the very beginning.

2. Which businesses require a licence, legal certification or diploma?

Research whether your type of business needs to meet any extra requirements, such as a licence or certain qualifications. In Belgium, it may be against the law for some types of businesses to start up without official permission. You will need a diploma or certificate for certain activities or professions.

Important to know… When in doubt, ask an expert!

💡 As you set up your business, you will have to make many important financial and legal decisions. The Re-Start Guidebook is a collection of helpful information and guidelines, but it is not legal advice. You should speak to a lawyer for that. It is also wise to go to an accountant for financial advice and an insurance broker for insurance advice.

3. Freelancer versus small business owner?

When starting a business in Belgium, think about whether you should become self-employed or start your own private limited company (SRL / BV). Both options have advantages and disadvantages, and the one that is best for you depends on your own personal situation.

Professions that are suitable for freelancing include: graphic designer, hairdresser, journalist, photographer… Decide from the beginning, whether you want to work as a freelancer, or start a company or a corporation. Do you want to be a one-person business or a company? Do you want to employ other people? Make a list of the pros and cons of being a freelancer compared to running a company. There are advantages and risks (legal and financial) associated with both paths.

The main advantages of being a freelancer are freedom and flexibility. You get to set your own schedule and build your own client list. You can also say no to possible clients who are not right for you. The main risk of being a freelancer is that all of the responsibility falls on your shoulders. If your business fails, you are held liable. In other words, you are personally responsible to cover the costs.

Being held liable means you may have to pay debts from your private assets. If you set up a corporation where the business assets are clearly set up separately from your private assets, then you are protected if the business fails. However, this process is more complicated and takes more time to set up. You could start your business as a freelancer, and then when your business grows big enough to need employees, you can turn it into a company.

New Words To Learn #1 Condition (noun): a rule or decision that you must agree to, sometimes forming part of a contract or an official agreement |

Chapter 2. Defining the Top 5 Business Models

The biggest decision to make when you start a business is what business model is right for you. This is important to know when you register your company and to decide if you need investors. Each business model has a different structure.

You will need to go through a notary depending on the sort of company you are forming and the notary can advise you on the business structure. A notary is a person authorised to perform certain legal formalities, especially to certify or draw up contracts, deeds, and other important documents.

Some of the things that affect the choice of company form are the number of founders, the amount of capital needed, how responsibilities and decisions are split, how money is raised, and how taxes are handled.

There are four main types of companies that may be formed in Belgium:

- The Private Limited Company (SRL / BV)

A limited company can be used for almost any kind of business. It can be started by one person or by several people. Depending on how many shares a person owns, they can vote, make money, and be responsible for debts. This form of company is especially suitable for start-ups and small and medium- sized companies. A big advantage of the limited company is that there is no need for starting capital. - The Partnership

Easy to set up, but risky due to the personal and unlimited liability. This means that the business owner and partners are fully and legally responsible for all business debts, and this liability has no limit, and must be paid through the partnership’s private assets. - Cooperative Company (SC / CV)

The people who belong to a cooperative association own the business. There can be one member or more than one. When a cooperative association meets, each member gets one vote. Members are only responsible for their share capital when it comes to the cooperative association’s obligations, such as debts.

The main purpose of a cooperative is not to make its shareholders rich, but to send the financial profits towards achieving a cooperative social goal. - Limited Liability Company (SA / NV)

Most suitable for large companies, with a starting capital at 61,500€.

| See here for more information. Also, here are some organisations that can help you set up your company: Dansaert, UNIZO en français and UCM. |

Another option: Freelancing

Don’t forget that another option is to be a freelancer…A simpler, less costly way of starting your business is to be a freelancer. This could be a good way to test your business idea/product/service on a small scale, to see if it will work as a larger company.

Becoming a freelancer is less complicated than setting up a company, but it still involves basic business skills of accounting, bookkeeping, time management, marketing and taxes.

Important to know… Receipts and Expenses

💡 All business owners (including freelancers) must keep an official account of incoming and outgoing payments. You keep your receipts to show what expenses you have. It is a good habit to send your expenses and receipts every month to your accountant, who will then use them for your tax return at the end of the year.

Infobox: The Risk of Starting a Business To start a business means taking a risk. It’s important to take calculated risks, and not unnecessary ones. Think ahead about what risks you are taking to prepare yourself for how to respond when something goes wrong. Many risks can be avoided by building a strong foundation for your business and putting things in the right place from the beginning. An example of this is choosing the right kind of company you should set up. Research the business models presented above, discuss them with trusted family or friends, and decide which one is best for you. The questions below will help you to think through this big decision. |

Important to know… Learn from other people’s mistakes

💡 Find someone who owns a successful company similar to the one you want to start, and ask them if you can have coffee and interview them. Ask them what worked well for them, as well as the mistakes they made. This is a great way to learn about the business!

Questions to Get You Started: Which Business Model Is Right For Me?

|

New Words To Learn #2 Business model (noun): a plan for running a business, identifying where the money will come from, who the customers are, how they will be reached, etc. |

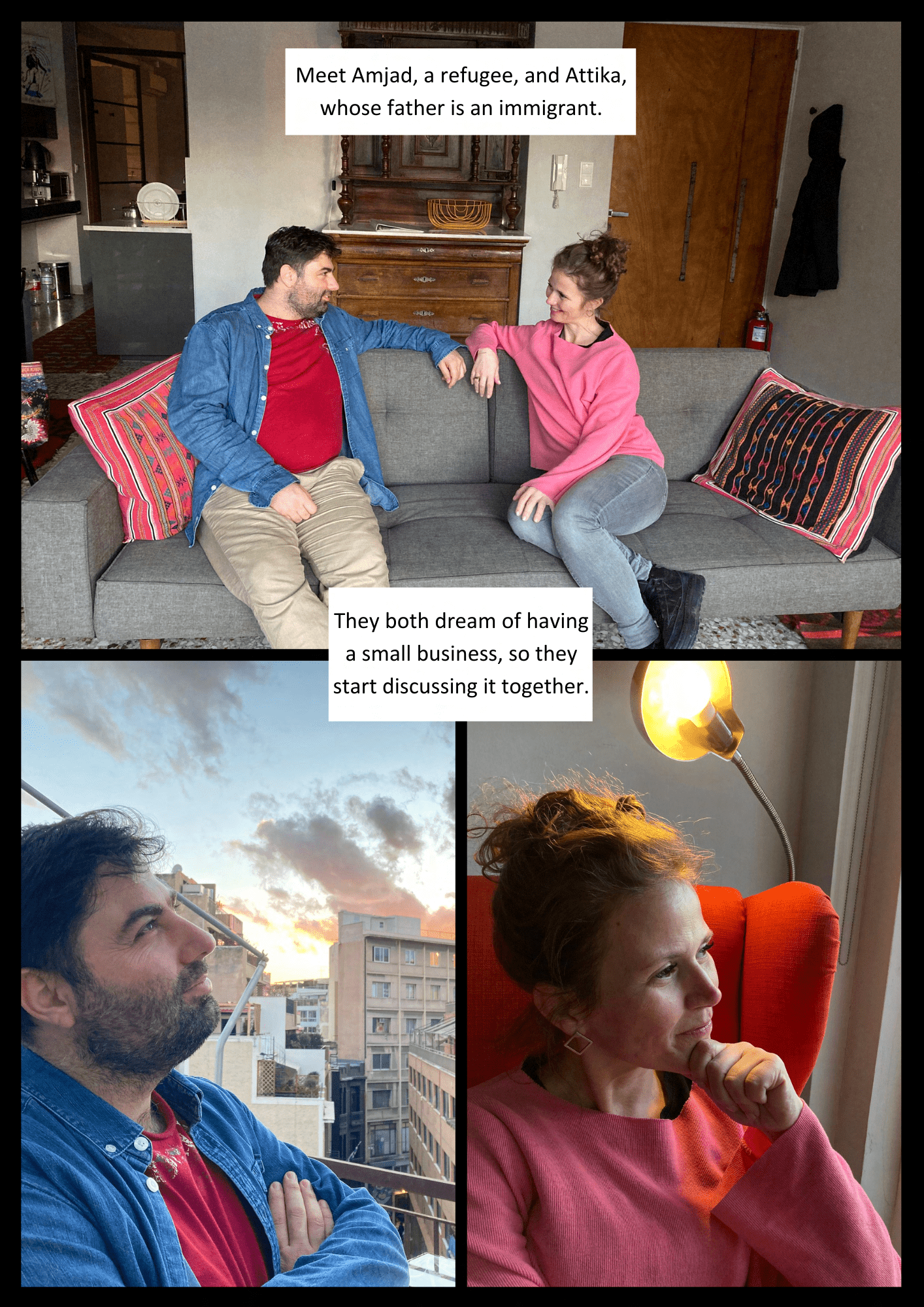

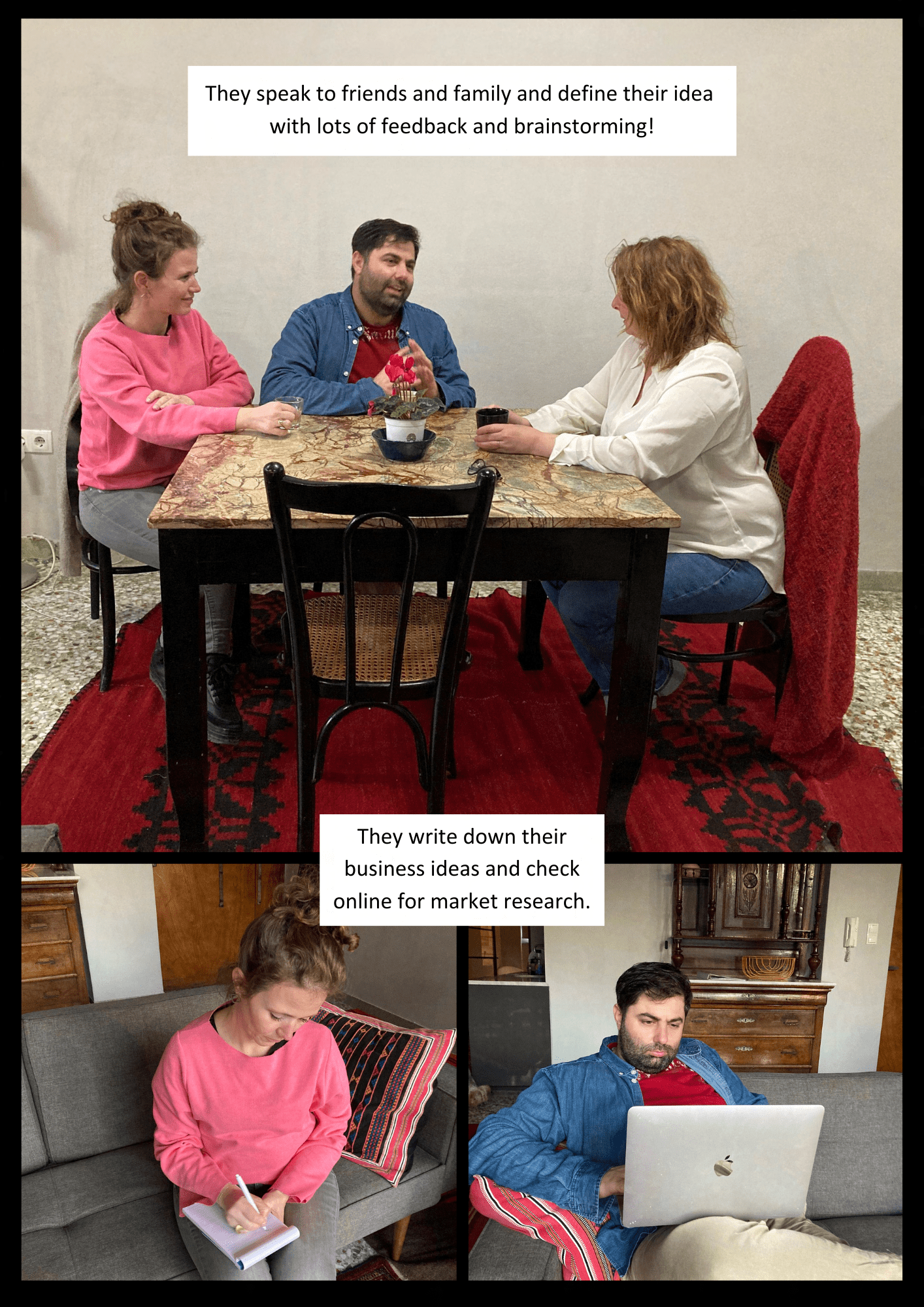

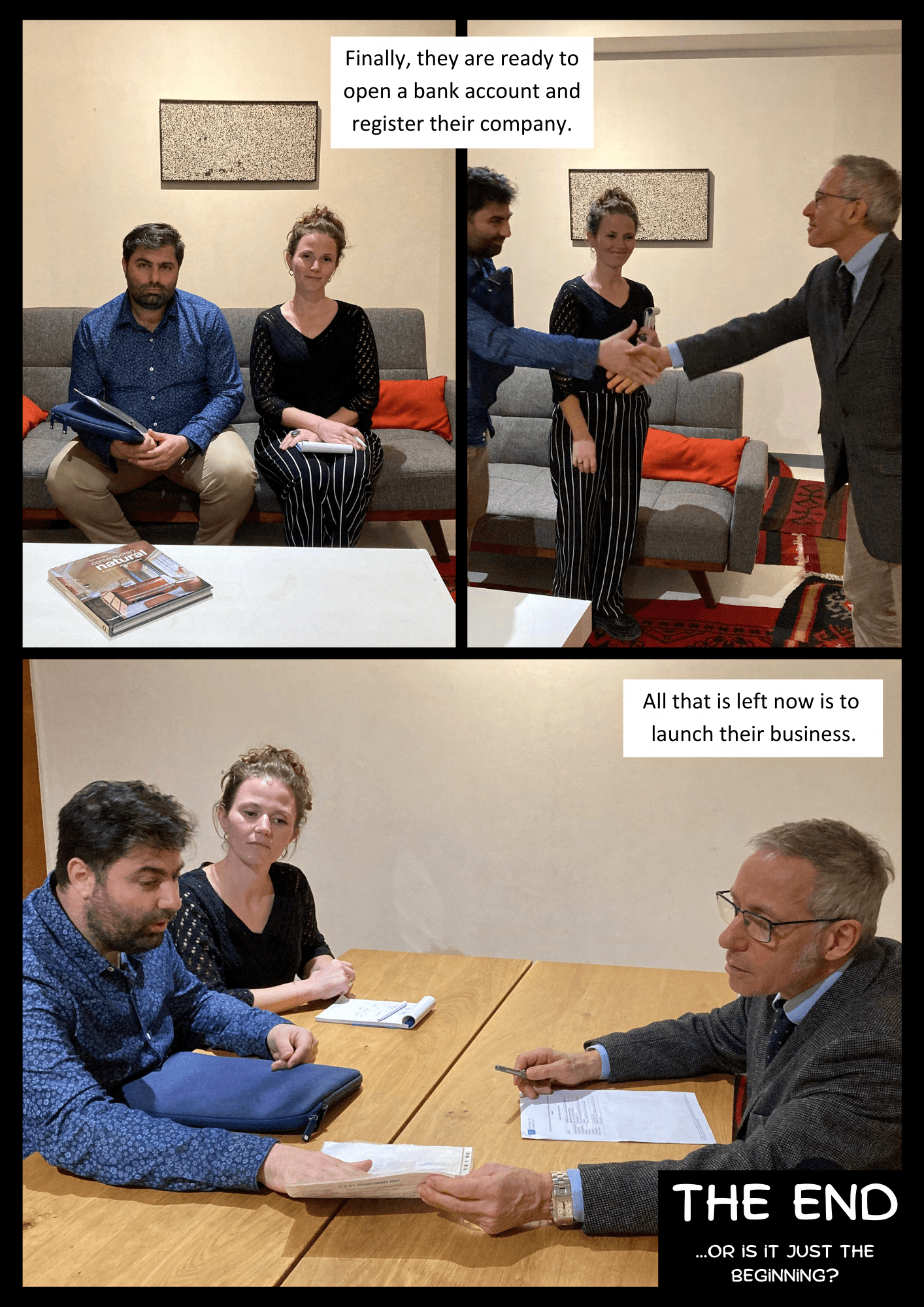

Chapter 3. The Migrant Entrepreneurs

Chapter 4. How to Start Your Business in 10 Steps

| 1. Make Sure You Have What It Takes Entrepreneurs are often confronted with challenges and periods of intense work. This means you probably will have to go through very stressful seasons. To make it through the stress, you need to have: ✓a good state of mind ✓motivation ✓resilience |  |

| 2. Define Your Project Well You need to have a precise idea of what it is you want to do, which sector you want to work in, and what type of business you want to create, whether it’s a shop, production facility, or online business. One important thing to determine is that your project will meet a consumer need or give a solution to a demand in the market. |

| 3. Build a Support System Around You It helps if you have a network of friends and family that you can rely on, who can support and advise you, especially when things get tough. As a relatively recent migrant or refugee in Belgium, if you can’t rely on your friends and family to give you this support, there are also organisations set up to help you. |  |

4. Build Your Skills Through Education

While you don’t need a degree to become an entrepreneur, it’s wise to pick a business that fits your skills and talents. All business owners should have a basic knowledge of accounting, bookkeeping, management, marketing and taxes. Grow your skills in these areas by taking a course or training. Look for adult classes that are offered in your local area or look for online courses.

| 5. Learn the Local Language Learning the local language is essential to succeeding as an entrepreneur. As a migrant or refugee residing in Belgium, you will want to ensure that you have a good understanding of French and Dutch to interact with your clients, partners, staff, authorities, and so on. |  |

| 6. Open a Business Bank Account It is good to organise your business finances to be separate from your personal finances. By creating a separate business bank account, it will be much easier for you to keep track of your ingoing and outgoing payments. |

Important to know…Having an official office address

💡 In Belgium it is necessary to have an official office address, even if you work from home. You can do this by renting a virtual office at most large co-working services such as Regus. They will provide you with an official address, send you your mail, offer phone concierge and store your statutes on location.

7. Test your Product/Service

You can greatly reduce the risk of failure by doing a pilot project, a prototype or a proof of concept. This gives you a chance to test and improve your product/service before you formally launch your company.

8. Don’t Hesitate to Ask for Help

You are more likely to succeed if you get help for your project. Six sessions with a career or life coach can have great results as a coach will help you to name and achieve your goals through practical steps. There are plenty of organisations to help you get started. They will often organise workshops and events to provide advice and the opportunity to network. You can also join an incubator or accelerator where you could meet a coach or even a future business partner.

9. Make a Financial Plan Every new business needs time before it can make a profit. As the company founder, you must have enough money not only to start the business, but to support yourself and your family until the business starts to make money.

Every new business needs time before it can make a profit. As the company founder, you must have enough money not only to start the business, but to support yourself and your family until the business starts to make money.

The purpose of the financial plan is to show how you will provide for the business and yourself. Make a list of all the start-up costs you will have to pay and put it next to a list of your financial capital (cash, property, savings, subsidies, and bank loans). There are institutions that can help you to get a loan, a microcredit, or a bank guarantee. Crowdfunding is another source of fundraising, but before you do this, you must be very clear about what funds you need, and exactly how you will use them.

10. Check the Legal, Tax, and Administrative Requirements

Consult with a notary or a lawyer about the legal requirements and responsibilities of starting a new company. It is also advisable to consult with an accountant from the beginning about what your tax situation is.

Questions to get you started: Research Your Project Inside Out

|

Infobox: Classic Business Ideas —> The Private Limited Company (SRL / BV)

|

Infobox: Classic Business Ideas —> The Private Limited Company (SRL / BV)

Depending on the region, you will also need to demonstrate that you understand the fundamentals of business management. Additional regional data is available on the following portal sites of regional institutions: |

New Words To Learn #4 Confront (verb): to deal with a problem or difficult situation |

Chapter 5. Coming Up with a Business Idea

Choosing your business idea is an active process. Look, observe, research, and read various sources and discuss them with other people as much as possible. Be curious and open!

Choosing your business idea is an active process. Look, observe, research, and read various sources and discuss them with other people as much as possible. Be curious and open!

Write a list of your skills, knowledge and interests. Where do your personal strengths lie? What is your expertise? What do you like to do outside of work that could possibly turn into a business?

Give yourself time to brainstorm, and list all the ideas that come to mind, both good and bad. After you have your list of ideas, go through it and answer the questions: “Is this possible? Realistic? Is this something I am able and willing to build?”

Search for inspiration online, there are many ideas out there about creating your own business. Perform searches, look into forums, social networks or crowdfunding websites to get ideas.

Search for inspiration online, there are many ideas out there about creating your own business. Perform searches, look into forums, social networks or crowdfunding websites to get ideas.

Look through patent databases, these will help you discover if others have thought of a similar idea. Or it could help you think of new opportunities, because many patent requests are no longer active, which means the idea is available for you to use.

Here’s a link to Espacenet, a large database provided by the European Patent Office.

Look up legislation, as new laws passed by lawmakers in parliament may provide incentives for the development of new technologies and new job profiles. This could give you business ideas.

Look up legislation, as new laws passed by lawmakers in parliament may provide incentives for the development of new technologies and new job profiles. This could give you business ideas.

Identify points of frustration, an unmet need or desire caused by a lack of existing offers or quality products. Ask yourself how you can improve and simplify the product/service. Anticipate what the customer is looking for and how you can make the process more efficient. Make your idea strong, because customers won’t change their habits unless your idea is worth the change.

Put all your ideas on paper (or on screen), this will make them concrete. Highlight the strengths and the most realistic aspects and analyse whether or not they will work in the real world. Try them on the people around you.

Put all your ideas on paper (or on screen), this will make them concrete. Highlight the strengths and the most realistic aspects and analyse whether or not they will work in the real world. Try them on the people around you.

Important to know…Advantages of Starting a Business as a Foreigner

💡 Look beyond the borders, look to your country of origin to find inspiration for your original business idea. Being a foreigner can be such an advantage, because you have experienced a totally different landscape and culture than Belgium.

Questions to Get You Started: Get Inspired By Your Culture and Homeland

|

New Words To Learn #5 Brainstorm (verb): to discuss a problem or issue and suggest solutions and ideas |

Chapter 6. Writing a Business Plan

Whatever the type of your project, the Business Plan is an essential tool. It will give you the roadmap for the next three to five years to guide you along the way and show how your company will be able to grow its revenue.

It will help to prepare you and give you support during possible negotiations with external investors. It will allow you to demonstrate the quality of the business opportunity, identify the risks, define the strategy and set targets.

As you build your business, you will measure your performance against the Business Plan and when necessary, make changes to meet your goals.

Your Business Plan should contain:

- A company description (a high-level review of the different elements of your business)

- A product/service description that highlights the benefits to potential customers

- A market analysis that illustrates your knowledge of the industry and market trends

- A current state and likely evolution of the market and the environment

- A long-term vision for the direction of your company

- A sales and marketing strategy

- A delivery method for the products or services

- The structure of your business administration

- The financial plan and financing methods

- A description of the human and financial resources. This should include

- your company’s organisational structure

- details about the ownership of your company

- the profiles of your management team

- the qualification of your board of directors.

- Missing resources and how you plan to fill them

- End with the key factors for success

Important to know… Board of Directors

💡 The Board of Directors is defined in Collins Dictionary as “the group of people elected by the company’s shareholders to manage the company”. They are responsible for guiding the direction and supervising the management of a company to ensure that it is successful and sustainable.

Questions to Get You Started: Writing Your Business Plan

|

New Words To Learn #6 Revenue (noun): the total income produced by a given source |

Chapter 7. Understanding Tax and Insurance Obligations

Taxes

Taxes

Taxes are something essential to consider when starting a business. Once again the way you set up your business will have different implications.

You will have to pay income tax and local tax and—depending on your product/services—Value Added Tax (VAT) on your sales or services. You will also pay your Social Security on a quarterly basis and fill in your yearly tax declaration, whether as a freelancer or for your company. For all of this, it is recommended that you hire an accountant.

Even before starting as a freelancer or forming your company, you should ask the business counter (“guichet d’entreprise”) and/or contact the notary you will employ about the financial implications of the various business structures.

Insurance

Insurance

Is insurance necessary for starting a business? Depending on the type of business you will work in you will indeed need different kinds of insurance.

If you have a shop or a factory you will need one to cover the risks to the place you rent or own (fire, water, damage to the windows, etc). You will also need to cover the risks to your inventory (damages and theft). And if you have employees you will need to cover them against injuries or other types of risks they could endure at work.

Business Insurance

Business Insurance

As a business owner, it’s important to have the right company insurance to protect and run your business. Talking to an expert is the easiest way to ensure you have enough insurance coverage. They will tell you what kind of insurance your business needs.

It costs a lot of money to pay insurance premiums. Still, you should think about whether you and your business can afford not to have enough insurance.

You should talk to a reputable insurance broker. They can tell you what kind of insurance your business needs and help you compare deals and negotiate packages that are affordable. They can also tell you about any laws you need to follow.

Most of the time, there are four main kinds of insurance: Vehicle Insurance, Personnel Insurance, Public Liability Insurance, and Building and Content Insurance.

Vehicle Insurance

Vehicle Insurance

By law, all cars must have enough insurance to cover damage to third parties. You can choose between two main types of insurance: third-party and comprehensive. If someone sues you for personal injuries and legal costs, you will need third-party injury insurance.

Comprehensive vehicle insurance covers any damage you do to your own car, as well as damage to other people’s cars or property, fire, and theft.

Personnel Insurance

This insurance will cover you and your employees if you or they get sick or hurt. An employer must give their workers insurance in case they get hurt or sick. But people who work for themselves aren’t covered by worker’s compensation. Instead, they have to get their own insurance through a private company. There are different kinds of insurance, such as income protection, trauma, life, and disability insurance.

| Public Liability Insurance |

| Building and Contents Insurance |

Other Kinds of Insurance

| Personal Insurance Some insurances are made to fit your everyday needs and cover you if you or someone else gets hurt or hurts your property or assets. |  |

| Home Insurance Home insurance covers your belongings in case of a fire, water damage, theft, or vandalism. Most of the time, the cost of your home insurance depends on how much it would cost to replace your home and the other things you have insured with it. So, home insurance is different for each person. |

Car Insurance

As is the case in all EU countries, all cars must have at least third-party liability insurance. A person who owns a car must get insurance to cover injuries and damage to the car and the people in it. There are two kinds of insurance: third-party and all-in-one. Third-party insurance makes sure that victims get paid for their injuries. At the same time, comprehensive insurance covers injuries and damages no matter who was at fault.

How much insurance you should get depends on your age, the kind of car you drive, and how long you’ve been driving. When you buy a car, you have seven days to register it in your name and get insurance.

Life Insurance

The better deal you’ll get on life insurance, the sooner you buy it. If you are young and healthy, you are more likely to get a better deal on insurance than if you are old and sick. Even if you have no family or other people who depend on you, you may still want to buy life insurance. Life insurance is made to fit the needs and situations of each person.

You need to know what kinds of life insurance are out there. Term insurance and investment insurance are the most common types of these.

Term insurance gives money and benefits to a person’s family or dependents if they die within the terms of the policy. For example, this could help them pay bills.

Term insurance gives money and benefits to a person’s family or dependents if they die within the terms of the policy. For example, this could help them pay bills.

Investment-type insurance includes things like endowment and “whole-of-life” policies, which are good as long as the premiums are paid. The part you invest will grow in value, and you can cash it out before you die.

It is important to keep in mind that you should shop around for a life insurance policy. It’s important to get a deal that fits your specific needs.

New Words To Learn #7 Implication (noun): the conclusion that can be made from anything regardless of the fact that it is not clearly stated. |

Chapter 8. Defining Your Brand

The product or service that you offer is unique to you: this is your brand. Your branding tells a customer who you are before you say a word. The company name, the colour and design of the logo, the font or colours of your storefront or website, and the way you talk about your product are all a part of catching the attention of your customer from the beginning all the way until you close the sale.

You identified your audience as you developed your business plan. You can use those answers on the next step of understanding your brand.

Before you get started, take 15 minutes to brainstorm these questions:

— What is the core value of my business?

— Who is the client I want to serve?

— What tone or style will attract my ideal client?

You can continue to refine the definition of your core values and ideal client. The more you develop your product/service and test it with family and friends, and eventually clients/customers, the better you will be able to see whether your brand is effective.

Important to know… The Ideal Client

💡 The ideal client is the customer who is just right for you. Imagine the person who sees your product or service and wants it immediately. Now imagine their characteristics – how old they are, what is their profession, their hobbies, do they have a family, are they a world traveller? All of these questions will help you determine who your ideal client is

Now take the answers from your brainstorming about your values and ideal clients, and apply it to your next task.

The Company Name

The Company Name

The company name is the official name of the company that you are creating as written in the company statutes. This is also known as the corporate name.

You might think choosing a name is a simple task, but it can be surprisingly difficult. The key is to come up with a name that is catchy, easy to remember and original.

So, time to play with words!

Questions to get you started: What’s In A Name? “A rose by any other name would smell as sweet.” Here are a few things to keep in mind when choosing a name:

|

Important to know…

💡 In Belgium there are two different kinds of names: the corporate name and the trade name. These can be the same or different. If the corporate (company) name is available, then you can also use it as your trade name – this is the name that appears on your business card and storefront.

When you choose the name of your company, make sure that it is free of rights: this means it should not be already registered or too similar to a company name already in use.

The notary you use to incorporate your company can check this for you. If the company name is available and suitable, then nothing should stop you from using it for your company name.

The company name is the public name for your business. It’s the name that will appear on the window of your shop, your Facebook page, your business card, and your advertisements.

The company name is the public name for your business. It’s the name that will appear on the window of your shop, your Facebook page, your business card, and your advertisements.

The Trade Name

The trade name is the public name for your business. It’s the name that will appear on the window of your shop, your Facebook page, your business card, and your advertisements. It can be the same as the legal corporate name of the business, but it can be different too. Here too, to avoid any legal risk, it is better to check if it isn’t already taken and used by another entity.

You can do this on the “Banque Carrefour des entreprises”. If you want (it isn’t a legal obligation but it is better to do so) you can register it as a trademark at Crossroads Bank for Enterprises (La Banque Carrefour des entreprises).

Keep It Original

Choose a name that will make your company noticeable immediately and if you want, you can include the type of business in the name. Don’t make it too restrictive, because later you might want to expand your business.

Another idea is to include your family name in the company name, if it is a family or single person business.

Use Your Imagination!

Make a list of names, based on your products or services. Take inspiration from your homeland and native language — test your idea on local friends to see if it is hard for them to pronounce, or if it has a negative meaning in Belgium.

For example, IKEA is short for Ingvar Kamprad Elmtaryd Agunnaryd – a combination of the founder’s name and city of origin.

Aim for Simple and Available

Choose a name that isn’t too complicated to write or remember. You can use abbreviations or acronyms, such as BMW, which is short for Bavarian Motor Works. Another option is a contracted name, which is a combination of two words. For example, FedEx is short for Federal Express. It helps to pick a name that sounds good and that is written as it is pronounced.

Important to know… Make sure the name is not in use

💡 Don’t forget to check if the name you’re thinking of is available, that there isn’t an existing company with a very similar or with the same name already. You can find this kind of information online on the Crossroads Bank for Enterprises website. You can also check which website names are available here.

New Words To Learn #8 Brand (noun): a type of product, service, etc. made or offered by a particular company under a particular name |

Chapter 9. Designing Your Visual Identity

Now that you have a company name, think about the visual identity of your business. Do you have a physical storefront or sign on the street? Or a website? How about business cards, letterhead and invoicing?

Design Elements

The design elements of your brand should all fit together to make a consistent visual style that sets you apart from your competitors. This process can be fun!

Think about what colours, images and fonts you like that communicate the values of your brand. Every element of your brand should match the values and tone you want to communicate.

Questions to get you started: Choosing Your Design Elements Back to the core: What are my company values? |

Now that you have answered these questions, you can start choosing what design elements best represent your visual brand identity.

Creating a Logo

The purpose of a logo is to instantly communicate your values through text, symbols, and/or colour. It’s often the case that the simpler a logo is, the better it is…

Whether you hire someone, ask an artist friend or design the logo yourself, these steps will help you know what you want:

- Brainstorm what colour, symbols or images communicate your brand.

- Get some pencils, markers and paper, and draw your ideas

- Play around with shapes, symbols and colours

- Research to see if that logo already exists, some imagery is more common than you think!

- Take a look at some famous logos (Nike, Google, Lidl, Instagram, Chanel) and analyse what makes them effective

- Look at your competitors to see what works for the successful companies

- Show your logo to family and friends to see if it’s working

After you get feedback, return to your desk. Make sure your logo is unique and make changes based on the thoughts from family and friends.

That’s it! Now you have a logo that is really “you” to attract your ideal client!

Speaking of your ideal client, knowing exactly who you want to reach will help you connect to the people who will most benefit from your product or service.

The point of having a strong brand is to connect you with your customer base.

Become crystal clear on what you are offering and who will benefit. If you can summarise this in a one-sentence pitch, then you are ready for the final step…

Marketing Your Product

You have tested your product/service and chosen a strong name and brand design. Now it’s time to share it with the world!

There are lots of different ways to spread the news about your new business:

– Print advertising (flyers, leaflets, posters or billboards)

– Print advertising (flyers, leaflets, posters or billboards)

– Television or radio ads

– Online advertising (Social media, Google ads)

– Search Engine Optimisation (SEO) to drive traffic to your website

– Cold calling (Calling potential customers and pitching them your product or service)

– Face to face meetings with potential customers or suppliers

– Word of mouth

Some people get the majority of their clients from Facebook and Instagram ads. Others drop off fliers to people’s homes. Before you sink a lot of money into any one form of marketing, research and test to see what works for you.

What’s important to remember is that YOU are your best advertisement for getting started. Your passion and knowledge about your new business will go a long way to create a client base.

Never underestimate the power of word of mouth!

New Words To Learn #9 Visual (adjective): having to do with seeing or sight |

Chapter 10. Finding Funding and Support

Now that you know your brand, you are ready to find support for it. Finding money for a new business in Belgium isn’t easy, but it’s not impossible either. No matter how much money the entrepreneur can put in, there are public and private ways to get money to start a business.

1. Public bodies: Entrepreneurs can get help and advice from some public institutions. Find the public body in your area that is in charge of entrepreneurship. They will help you make a business plan and answer any questions you may have about how to get the money you need to get started.

1. Public bodies: Entrepreneurs can get help and advice from some public institutions. Find the public body in your area that is in charge of entrepreneurship. They will help you make a business plan and answer any questions you may have about how to get the money you need to get started.

2. Business incubators: Incubators are organisations whose only purpose is to help startups and new businesses grow. They give these businesses a place to go for help and help entrepreneurs get access to services they need to run their businesses.

3. Venture capital companies: These are direct investment financial institutions or investment funds that take temporary stakes in the capital of companies at different stages of their life cycle. The aim is that with the help of venture capital, the company increases its value and once the investment has matured, the venture capitalist withdraws at a profit.

4. Startup Incubators and Accelerators: A business incubator is an organisation designed to accelerate the growth and ensure the success of entrepreneurial projects through a wide range of business resources and services that may include rental of physical space, capitalisation, coaching or networking.

5. Business angels. These are private investors who provide capital for the creation of companies in exchange for a shareholding. These business angels invest with their own funds, unlike venture capital firms, which professionally manage third-party money through a fund.

6. Crowdfunding. Building from the community or a group of people is one way that is becoming more popular. In other words, a lot of people give small amounts of money to help get the business started. Crowdfunding has often been used for artistic projects, but there are more and more platforms for business projects and new businesses.

7. Grants and subsidies: The different public administrations grant subsidies. The Directorate General for Industry and Small and Medium-sized Enterprises has just presented the Dynamic Guide to National Grants and Incentives for the creation of companies (by Autonomous Community).

Other possibilities

Find out about self-funding, win-win loans, crowdfunding, venture capital, PMV corporate loans and (non-)bank financing in Belgium and Flanders. Discover additional structural funds

See the following companies for further advice on funding:

Information on Crowdfunding in Belgium.

Wallonia and Brussels

The Be Angels network is supported by the Brussels-Capital Region and the Walloon Region, among others.

Investment allowance SMEs in Wallonia can apply for an investment allowance. You must have a business unit that is registered in Wallonia to be eligible (or, that you will create one there). There are different amounts of money you could get. It depends on the type of business, where the investment is being made, how many jobs are likely to be created, what the main focus of the activity is, and what scheme you are applying for.

This Wallonian investment allowance focuses on encouraging sustainable energy use and environmental protection. So, if you are planning to invest in green equipment this is a great funding opportunity for your small business.

1890.be is a good place for small businesses and entrepreneurs in Wallonia to go to get information and advice. They put together lists of funding and financing options that are mostly for companies in their early stages.

S.R.I.W.(Société Régionale d’Investissement de Wallonie) offers financial support for various contexts or activities. S.R.I.W. helps you find the right kind of financing for your needs. This could mean different kinds of loans (subordinate, convertible, equity, pari passu), capital investments, joint capital, etc. S.R.I.W. support is made to fit the needs and situations of each company. For people who want to apply, there is an online form to fill out.

The Wallonia Investment and Growth Fund (W.IN.G) by Digital Wallonia is managed by S.R.I.W. Its mission is to finance small business growth, particularly digital startups, and to provide mentorship and networking.

Finance and Invest Brussels are a limited company of public interest which facilitates and completes the financing chain for companies that create value in the Brussels Region.

Flanders:

Support for ecological investment

VLAIO offers two kinds of grants to companies in Flanders that invest in eco-friendly projects, initiatives and assets: Ecology Premium Plus (EP PLUS) and Strategic Ecology Support (STRES). Is your company going green? You can apply online.

Learn more about eco grants awarded by VLAIO.

Research and development grants

To support innovation by companies in Flanders, VLAIO offers many support services and subsidies to companies, research centres and other legal entities engaged in R&D projects. Learn more about VLAIO’s R&D funding.

Support for small and medium-sized enterprises (SMEs)

To help SMEs – whose operational activities are headquartered in Flanders – further develop and grow, support agency VLAIO offers two types of financial aid for training and advice: the SME e-wallet and SME growth subsidy. Learn more about VLAIO’s grants for small and medium-sized businesses.

Governmental support agencies in Flanders

Two main agencies, Flanders Innovation and Entrepreneurship (VLAIO) and Participatiemaatschappij Vlaanderen (PMV) offer support to companies investing in Flanders. Discover Flanders’ support agencies.

Innovation support from Flanders’ clusters

Do you work in a strategic industry in Flanders? If so, the spearhead clusters in the area will welcome new ways to do things. Learn about Flanders’ spearhead clusters.

Foreign companies set up in Flanders also gain access to various European funding programs, like Horizon Europe. Discover more about European funding.

Support and training

Consider finding a mentor or a coach to support you in building your business.

Duo for a Job – an NGO that matches in a duo a young person (the mentee, 18 to 33 years old) newly arrived in Belgium or that has their origins in a country outside of the EU with a local Senior (the mentor, above 50 years old). They will work together to (better) define the career project for the mentee and to learn how to navigate the job market in Belgium.

Microstart – MicroStart provides advice and grants microcredits to (starting) entrepreneurs who do not have access to financing from “regular” banks.

Brussels Formation organises trainings on management and accounting for job seekers and entrepreneurs.

IFAPME in Flanders and EFPME and In Wallonia, manages the training of future managers. There are also a number of policies in place to encourage young people to start their own businesses and help them do so.

Startup Lab empowers and supports young entrepreneurs from idea to action by giving tools and information and using our position within Belgian entrepreneurial ecosystems and institutions.

Job Yourself JobYourself gives anyone who is looking for work and wants to start their own business or wants to become self-sufficient while they are unemployed the chance to develop and test their idea in a legal, structured, safe, and ethical way.

New Words To Learn #10 Public bodies (noun): formally established organisations that are, at least in part, publicly funded to deliver a public or government service |

Conclusion

In this guidebook…

You have learned:

The legal steps to opening a business in Belgium

You have compared:

Different types of businesses and which one is right for you

You have tested:

How to come up with a solid business idea

You have developed:

A business plan to set you up for future success

You have explored:

Branding and how to create a unique brand identity

You have brainstormed:

Marketing your business so you stand out from the crowd

And you have researched:

How to support your venture through financing and training

…You have all the tools you need, so go for it! Take the plunge!

Starting a business is not for the faint of heart, it means taking risks, trying new things, learning from your mistakes, picking yourself up when you fail, adapting and trying again.

You now have the tools to launch a business, and next you will have to learn how to keep a business running.

Be persistent. Be curious. Be ready to learn. Be patient with yourself. You are building your business in a new culture!

When you face a set-back (yes, this happens to everyone!) and you feel stuck, don’t lose hope. Take a moment to breathe, take a shower, go for a walk, look at a view over the city or the green of a local park. These things will change your perspective and help you to focus on the positive.

Remember, this is a marathon and not a sprint.

You got this!

Contact

If our handbook has helped you start a business, we would love to hear from you!

Email your story to barbara@welcomehome.international

We look forward to encouraging you on your way, to cheer you on during the hardships and

celebrating your successes with you!

Bibliography

Belgium

“Find the Right Name for Your Company.” 1819.Brussels, 31 Mar. 2023, 1819.brussels/en/

information-library/starting-business/find-right-name-your-company.

sathyasnkr. “From Problem-Solving to Profit: How Starting a Business Can Be the Solution.” Tastesy, 14 Feb. 2023, www.tastesy.in/how-solving-a-problem-can-lead-to-starting-a-successful-business.

“Setting up a Business as a Foreigner (non-European Resident): The Professional Card.”

1819.Brussels, 26 Sept. 2022, 1819.brussels/en/information-library/start-business-formalities/setting-business-foreigner-professional-card.

Brief, Entrepreneurs. “Entrepreneurs Brief – Entrepreneurs Brief.” Entrepreneurs Brief –

Entrepreneurs Brief, 27 Mar. 2023, entrepreneursbrief.com/author/admin.

Portugal

“A Guide to Starting a Business in Portugal (2023).” Imacoconow, 18 Feb. 2023, imacoconow-com.ngontinh24.com/article/a-guide-to-starting-a-business-in-portugal.

“Become a European Resident With a Business in Portugal.” Become a European Resident With a Business in Portugal., www.linkedin.com/pulse/become-european-resident-business-portugal-denzil-alachia.

“Business Consultancy – Ambitious PT.” Business Consultancy – Ambitious PT, ambitiouspt.com/business-consultancy.

Natalia. “How to Start a Company in Portugal – Get NIF Portugal.” Get NIF Portugal, 26 Oct. 2022, getnifportugal.com/how-to-start-a-company-in-portugal.

https://etsglobaltravel.com/start-a-business-in-portugal/

“Setting up a Business in Portugal – Guide – Expat.com.” https://www.expat.com/, 23 July 2014, www.expat.com/en/guide/europe/portugal/10796-setting-up-a-business-in-portugal.html.

“START a BUSINESS IN PORTUGAL – ETS Global.” START a BUSINESS IN PORTUGAL – ETS Global, etsglobaltravel.com/start-a-business-in-portugal.

“Portugal: Non-profit/For-profit Company Registry Requirements.” Portugal: Non-profit/For-profit Company Registry Requirements, neo-project.github.io/global-blockchain-compliance-hub//portugal/portugal-registry-requirements.html.

Jeremiah. “5 Steps to Set up a Business in Portugal for Expats | RHJ Accountants.” RHJ Accountants & Associates, 25 Oct. 2020, rhjaccountants.com/how-start-a-business-in-portugal.

Finland

“Starting a Business in Finland.” Starting a Business in Finland, www.infofinland.fi/en/work-and-enterprise/starting-a-business-in-finland.

“YEL Insurance, i.e. Self-employed Persons’ Statutory Pension Insurance.” YEL Insurance, i.e. Self-employed Persons’ Statutory Pension Insurance | OP, www.op.fi/en_us/corporate-customers/insurance/personal-insurance/yel-insurance.

“YEL Insurance, i.e. Self-employed Persons’ Statutory Pension Insurance.” YEL Insurance, i.e. Self-employed Persons’ Statutory Pension Insurance | OP, www.op.fi/corporate-customers/insurance/personal-insurance/yel-insurance.

“Valtioneuvoston Yhteinen Julkaisuarkisto Valto.” Etusivu – Valto, julkaisut.valtioneuvosto.fi.fi.

“Start-up Grants – Ministry of Economic Affairs and Employment.” Työ- Ja Elinkeinoministeriö, tem.fi/en/start-up-grants.

“Nordic Mentoring Summit.” Nordic Mentoring Summit, www.nordicmentoringsummit.com.

“Entrepreneurship Education – YritysHelsinki.” YritysHelsinki, www.yrityshelsinki.fi/en/education.

“Permits and Obligations – Suomi.fi.” Permits and Obligations – Suomi.fi, www.suomi.fi/company/responsibilities-and-obligations/permits-and-obligations.

Spain

https://quattroasesoria.com/how-to-create-a-company-in-spain-as-a-foreigner/. quattroasesoria.com/how-to-create-a-company-in-spain-as-a-foreigner.

balcellsg. “The 8 Steps to Set up a Company in Spain (Types, Costs and More).” Balcells Group, 22 Aug. 2018, balcellsgroup.com/steps-to-set-up-a-company.

Firmalex. “How to Start a Business in Spain as a Foreigner: Who Can Start a Business in Spain? – FIRMALEX.” FIRMALEX, 15 July 2022, firmalex.com/en/2022/07/15/how-to-start-a-business-in-spain-as-a-foreigner-who-can-start-a-business-in-spain.

“Starting a Business in Spain Guide 2023 | MSV.” My Spain Visa, 2 June 2023, myspainvisa.com/starting-business-spain.

SpainDesk. “Differences Between SL and SA Businesses in Spain &Ndash; SpainDesk.” SpainDesk, 12 Jan. 2022, www.spaindesk.com/differences-between-sl-and-sa-businesses-in-spain.

Subinas, Paul Urrutia. “How to Become Self-Employed in Spain? – IR Global.” IR Global, 10 Nov. 2022, irglobal.com/article/how-to-become-self-employed-in-spain.

“What Is an Asset?” Investopedia, 7 Sept. 2021, www.investopedia.com/ask/answers/12/what-is-an-asset.asp.

“What Is the NIE in Spain?” What Is the NIE in Spain? A Step-by-step Guide – N26, n26.com/en-eu/blog/nie.

The Re-Start Guidebook for Migrant Entrepreneurs

Copyright © 2023 Welcome Home International

Self-published

info@welcomehome.international

All rights reserved. No part of this book may be reproduced or used in any manner without the prior written permission of the copyright owner, except for the use of brief quotations in a book review.

Written and Edited by:

Talitha Brauer and Barbara Winn-Hagelstam

Writing and Research by:

Marja-Liisa Helenius

Yves Kanarek

José Carlos León

Sofia Mexia

Editing, Layout and Design by:

Talitha Brauer and Barbara Winn-Hagelstam

Photography by:

Talitha Brauer

Illustrations by:

Zdenek Sasek

http://www.zdeneksasek.com

The Re-Start Guidebook for Migrant Entrepreneurs is co-funded by Erasmus+

| The consortium of the Restart project is: Welcome Home International (Belgium) Learning for Integration (Finland) Tropical Astral (Portugal) Indepcie (Spain) |

Disclaimer:

The European Commission support for the production of this publication does not constitute an endorsement of the contents which reflects the views only of the authors, and the Commission cannot be held responsible for any use which may be made of the information contained therein.

Project Re-Start – Refugee Start-Up resources to facilitate

entrepreneurship and business development for refugees and migrants

2021-1-BE01-KA210-ADU-000034932

Download or print The Re-Start Guidebook for Migrant in PDF here.